PennyPal: Rethinking Budgeting for Students

Making personal finance simple, intuitive, and actually usable for college life

Timeline: 2 months

My Role: UX Research · Interface Design

Team: 4 members

Challenge

College students juggle a lot with very little financial cushion. We met students who were stressed, uncertain, and overwhelmed by budgeting. Most tools out there made them feel worse.

PennyPal was our attempt to shift that. The goal? Build something flexible, smart, and reassuring that would help students not just track spending, but feel okay doing it.

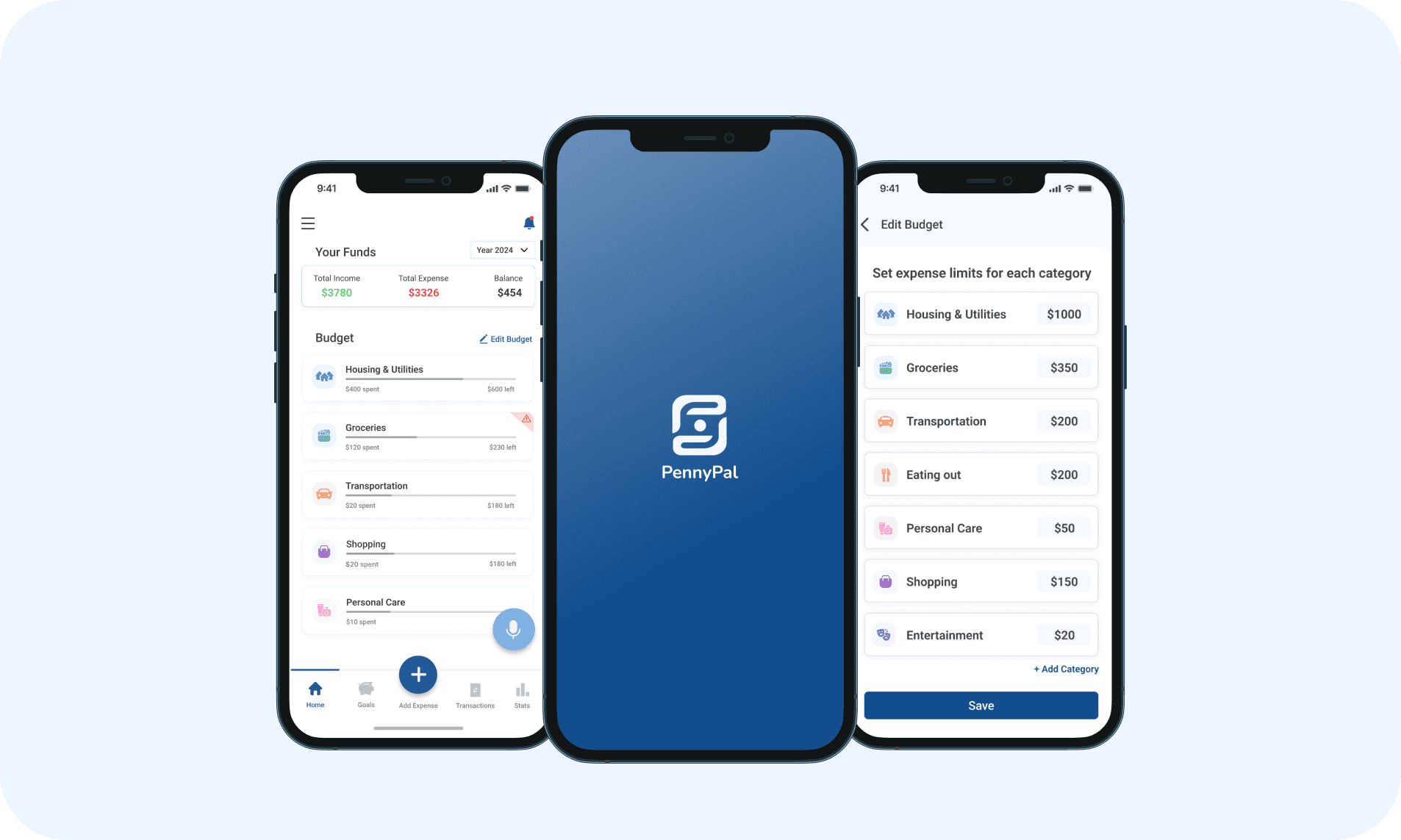

Solution

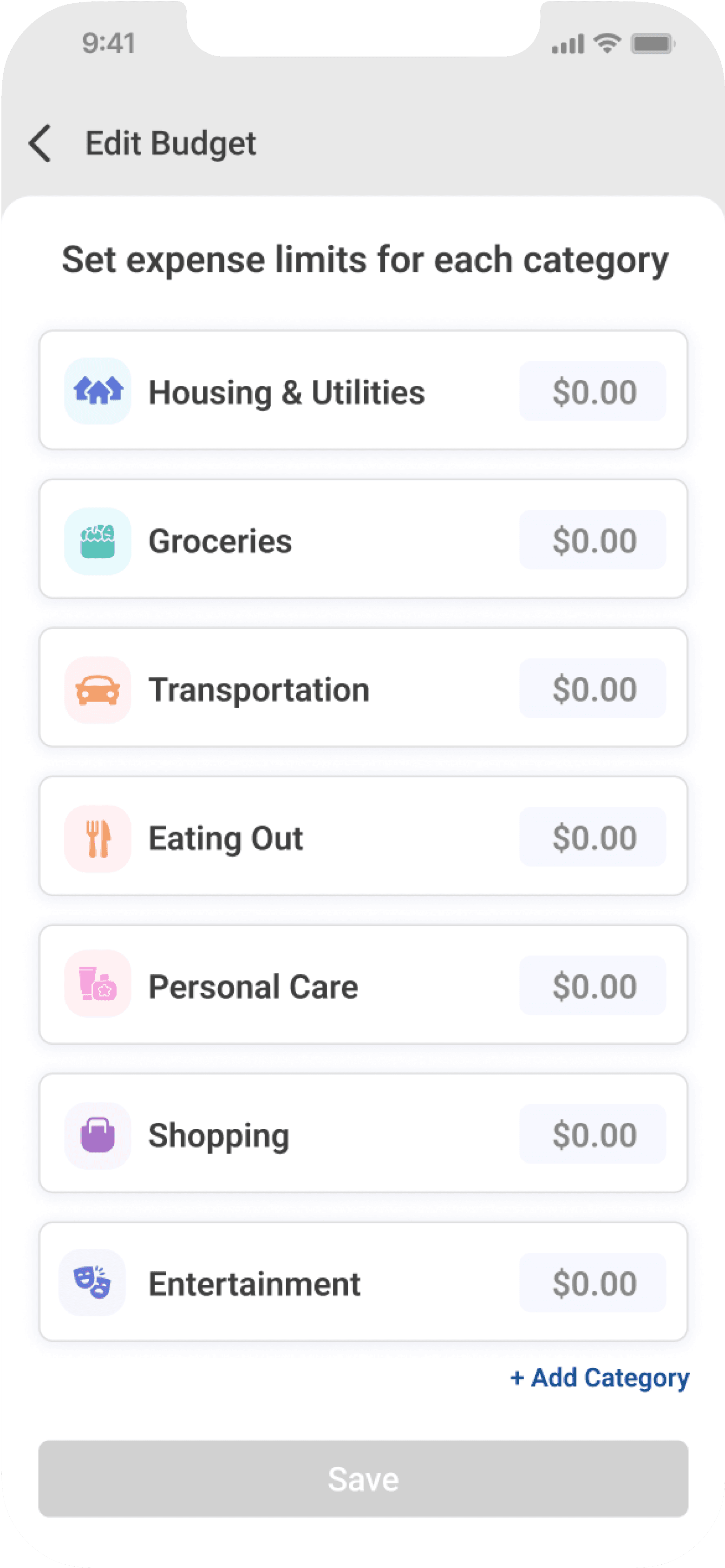

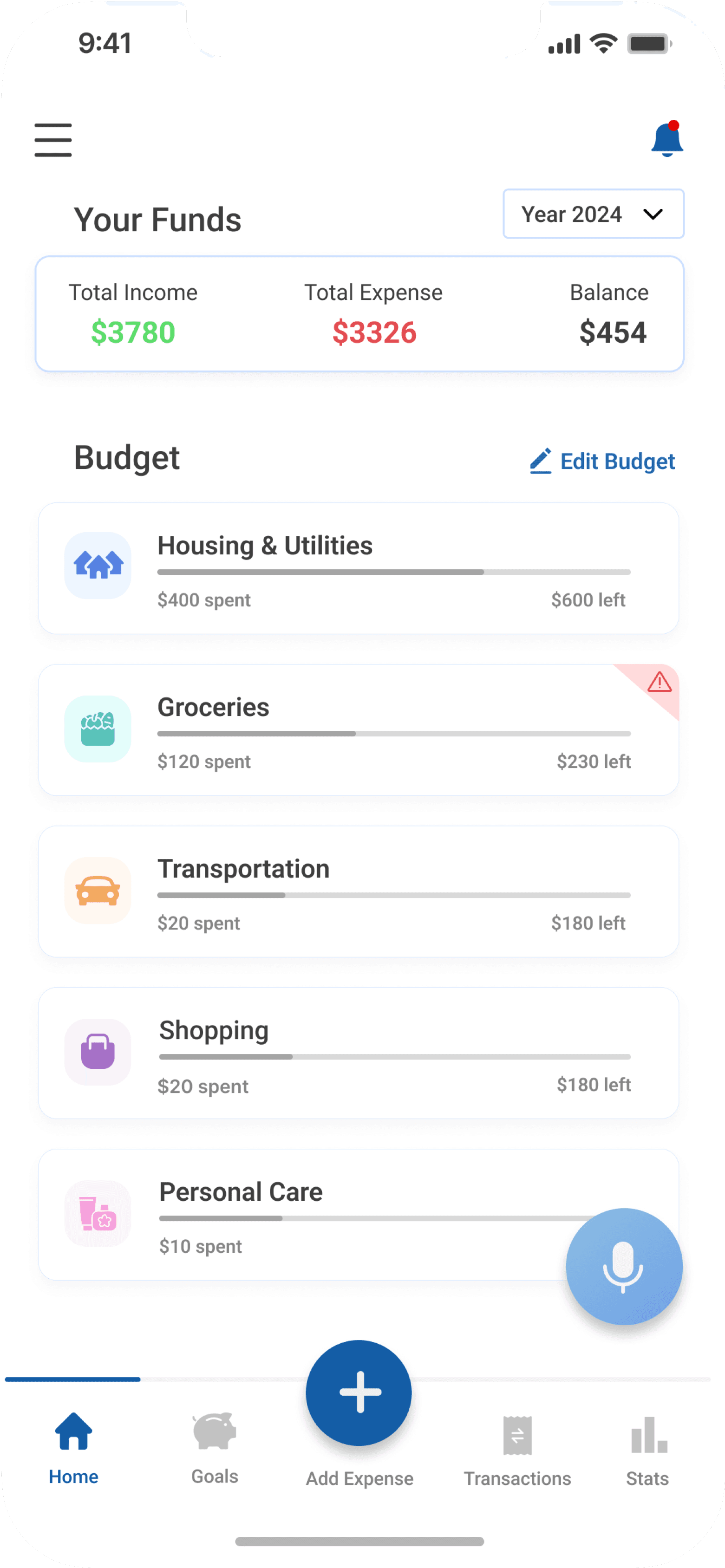

Housing & Utilities

$600 left

$400 spent

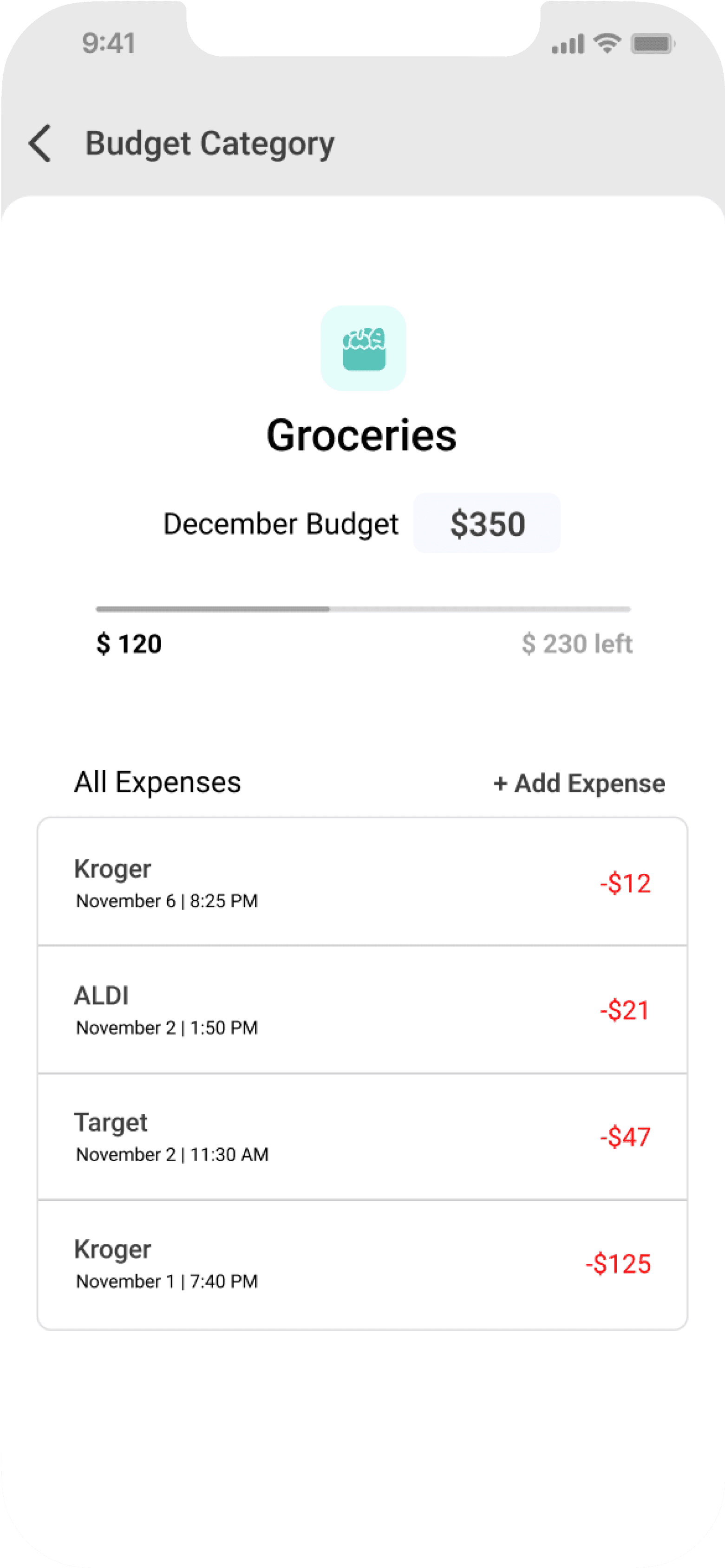

Groceries

$230 left

$120 spent

Transportation

$180 left

$20 spent

Shopping

$180 left

$20 spent

Personal Care

$10 spent

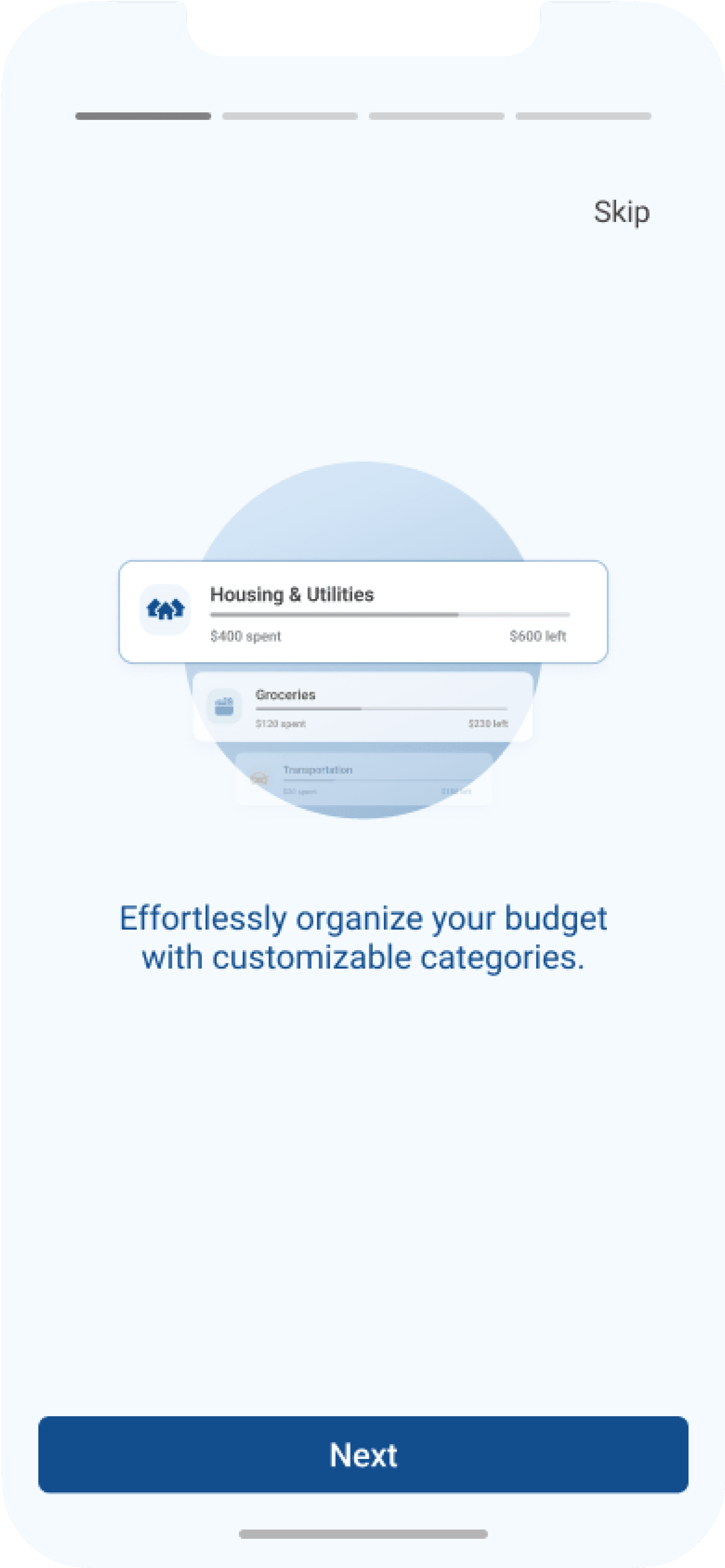

01

A dashboard that brings clarity

Users can see where their money was going, without hunting for it

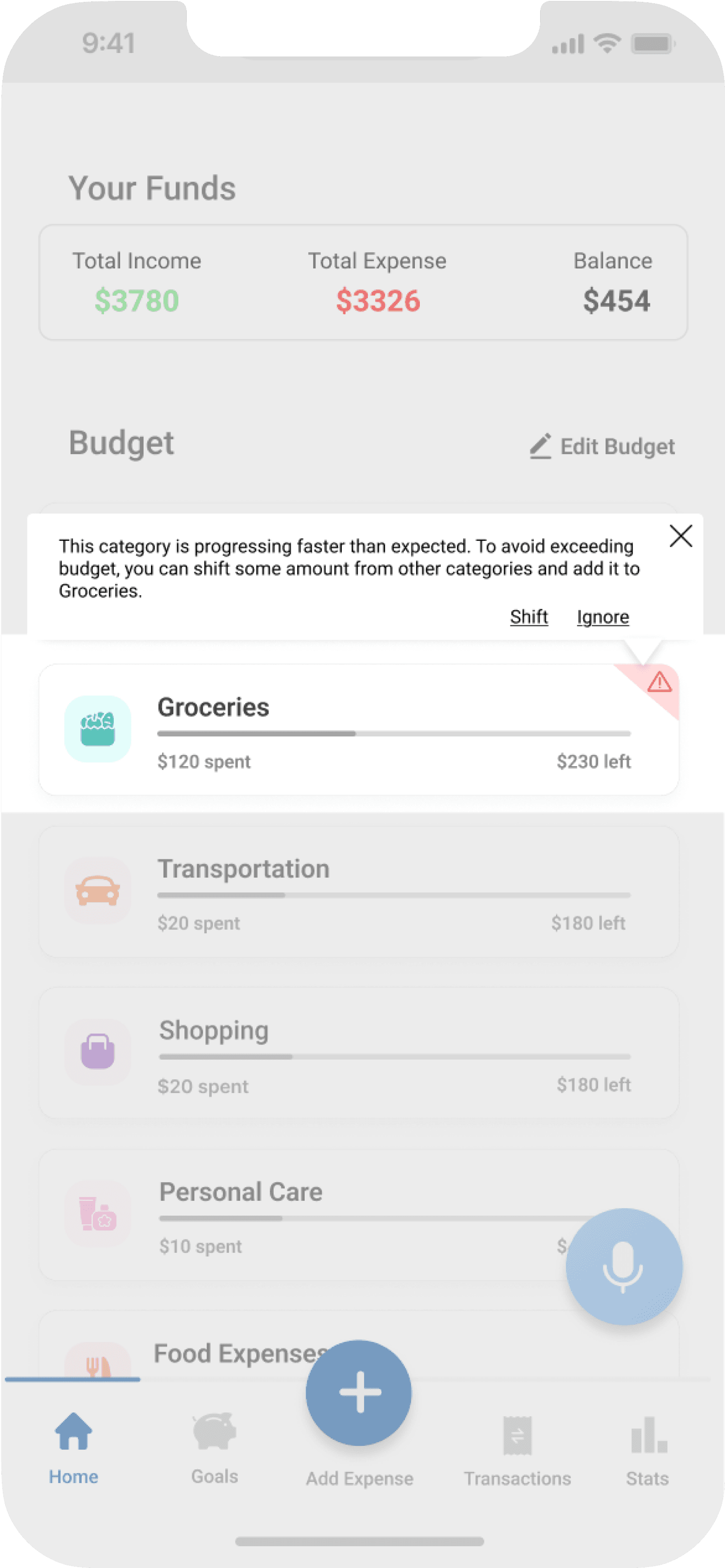

This category is progressing faster than expected. To avoid exceeding budget, you can shift some amount from other categories and add it to Groceries.

Shift

Ignore

Groceries

$230 left

$120 spent

02

Smart nudges that feel supportive

Gentle prompts to readjust budget when a category is spending rapidly

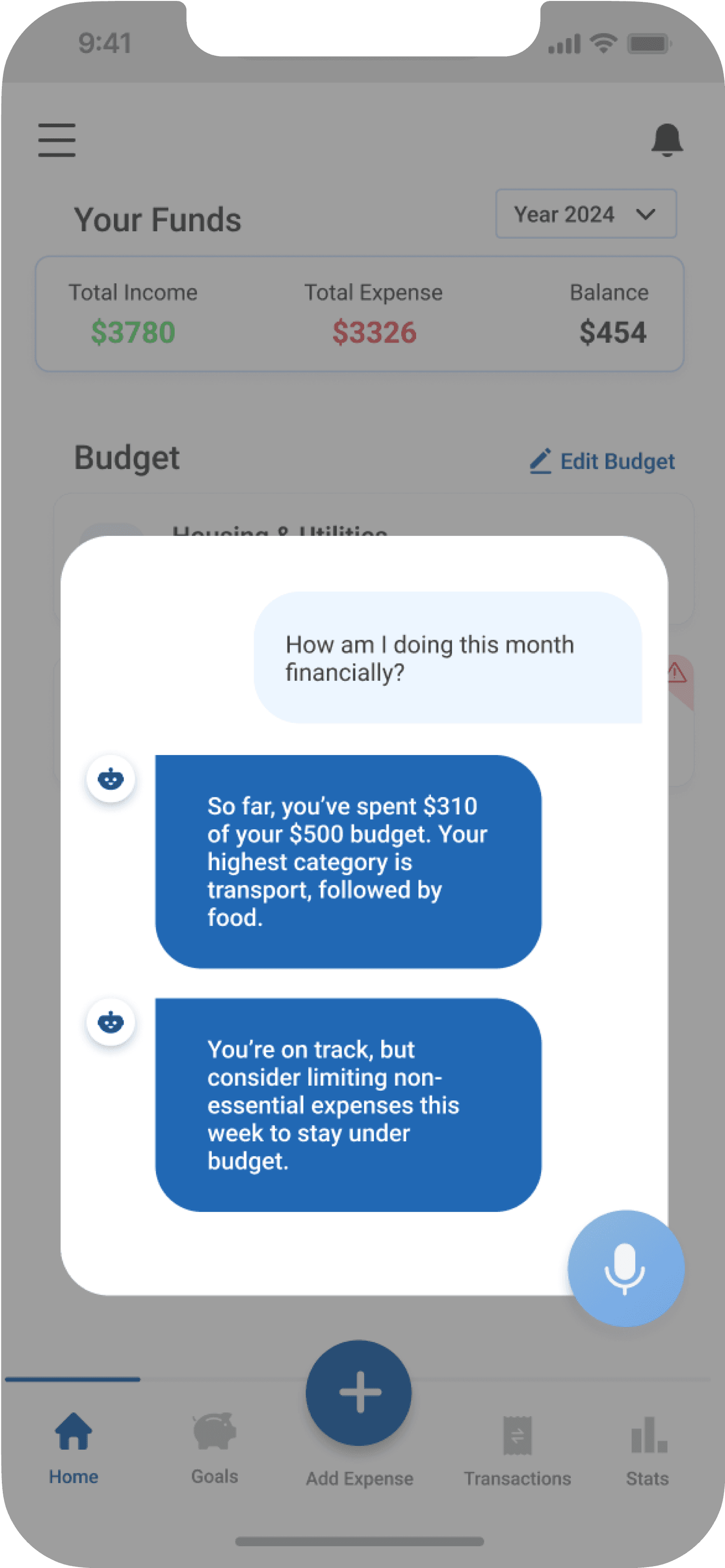

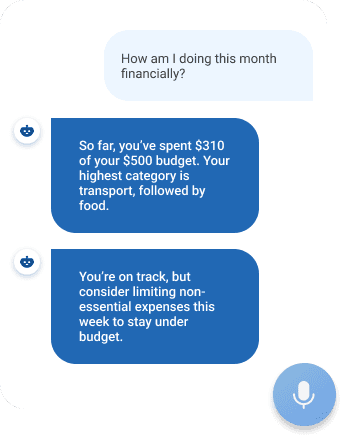

03

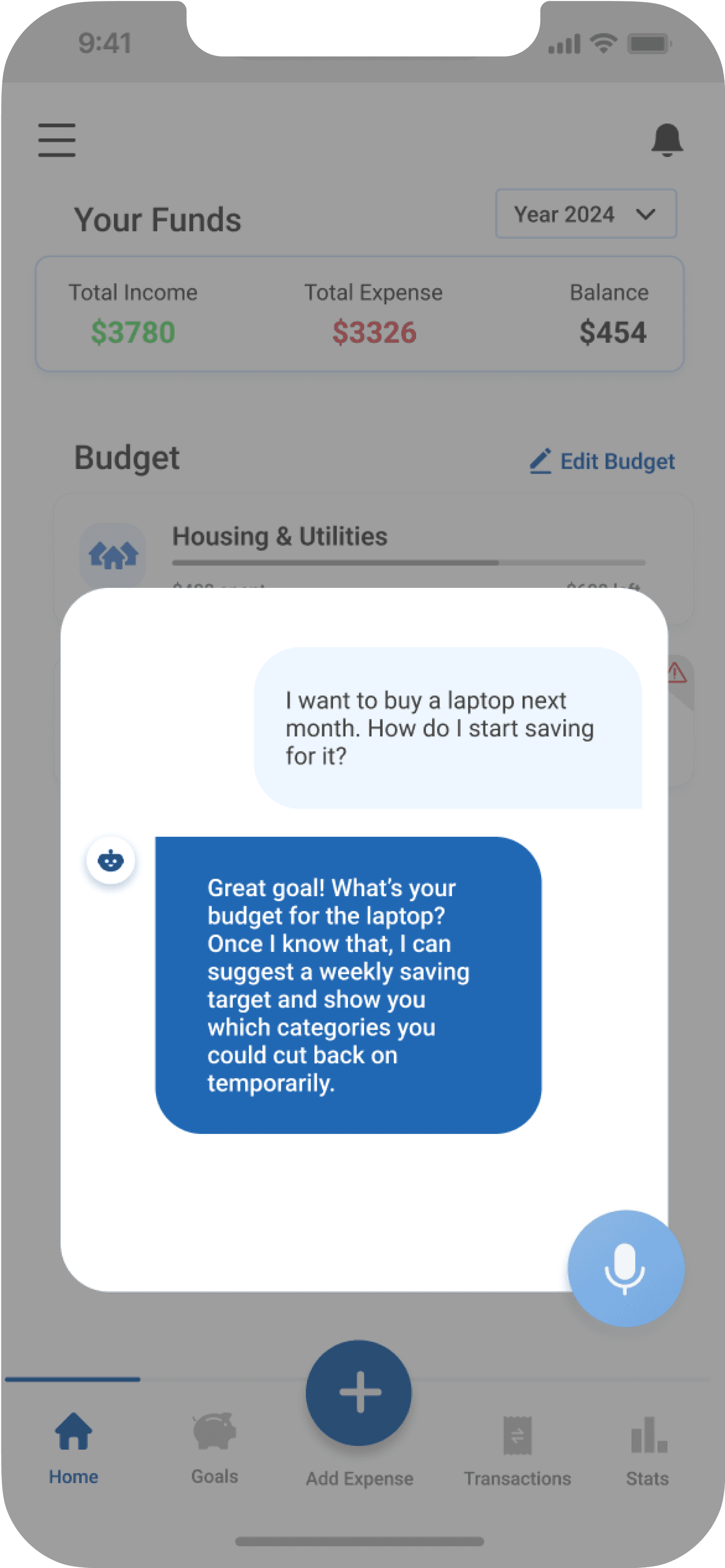

An AI assistant that makes life easier

Helps record transactions, learns from spending habits, and offers tips

Uber

November 1 | 2:10 PM

-$12

AES

November 1 | 7:40 PM

-$125

Amazon

November 2 | 11:30 AM

-$47

Kroger

November 6 | 8:25 PM

-$12

Zelle Payment from Jack

November 2 | 1:50 PM

+$21

Zelle Payment to Emily

November 1 | 10:15 AM

-$35

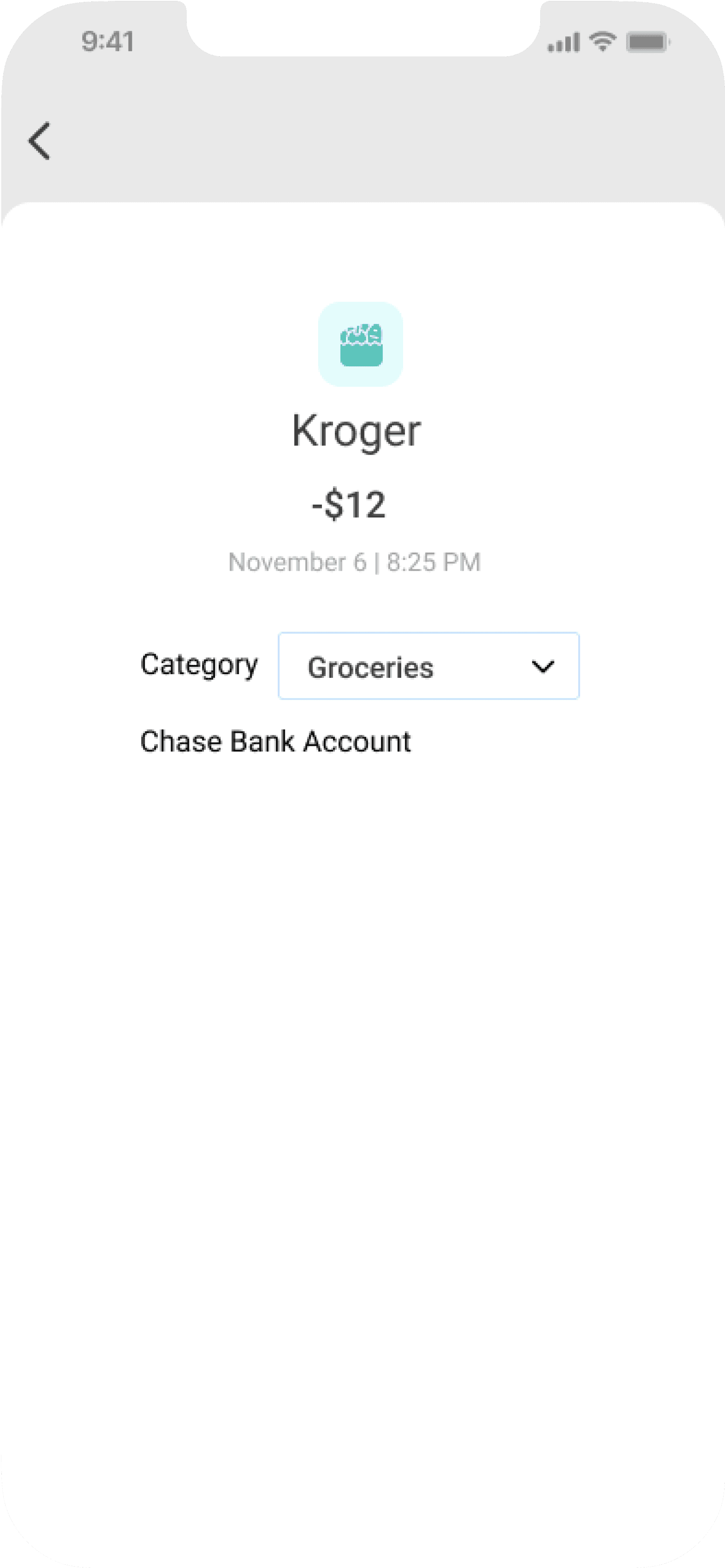

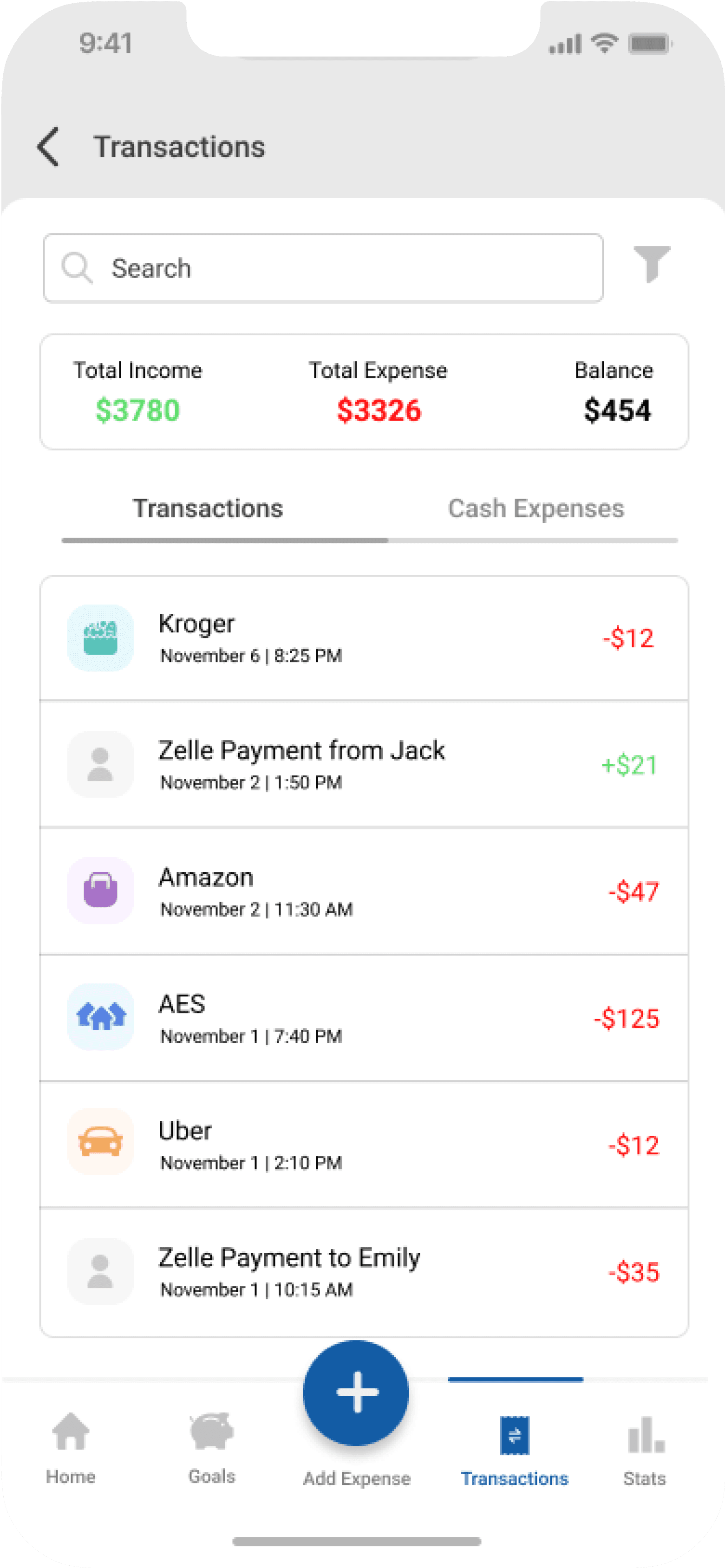

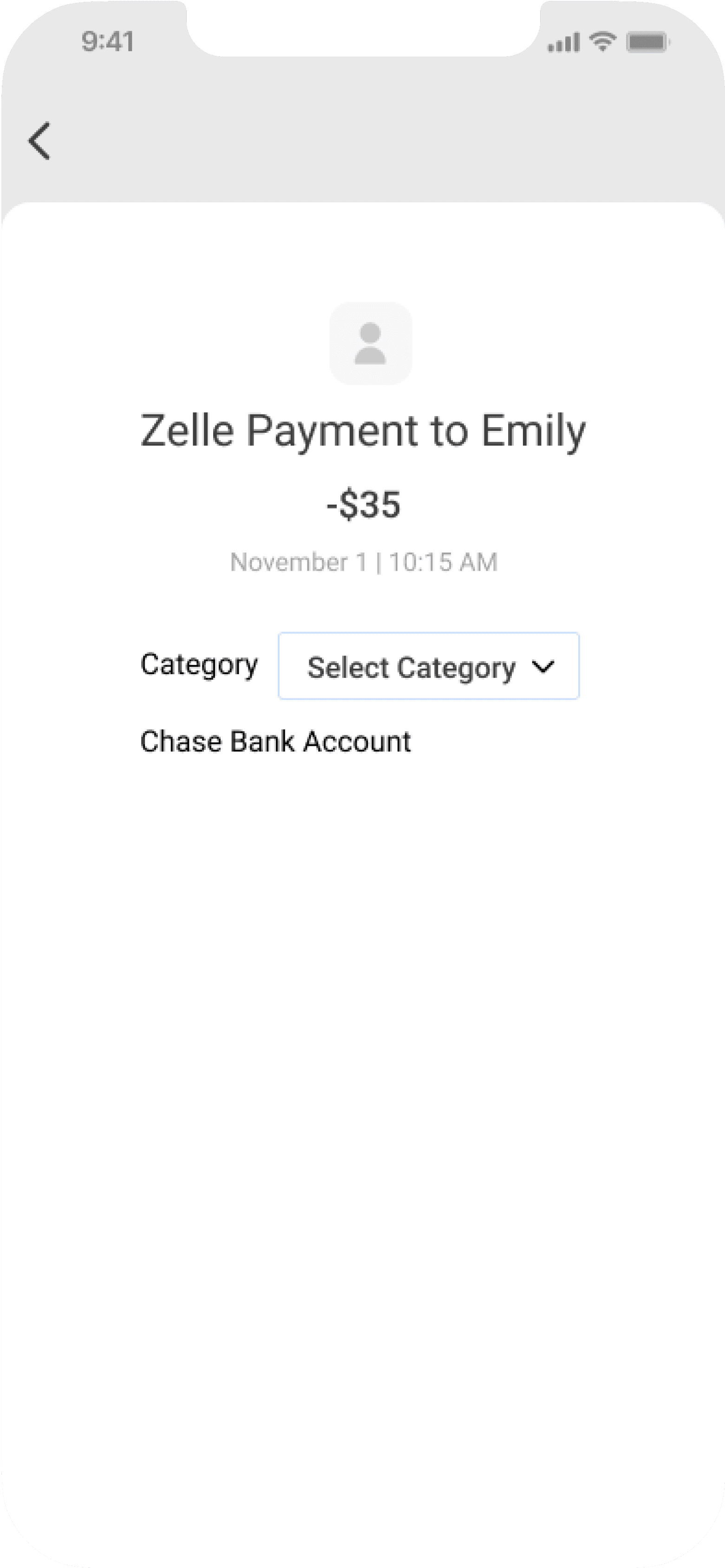

04

Auto categorization that saves time

Gentle prompts to readjust budget when a category is spending rapidly

How did we get there?

It all starts by talking to the users...

We interviewed 20 students, undergrad, grad, PhD, over two weeks. We wanted to hear it straight from them: what was hard about money, what they currently do (or don’t), and what would help.

What came up again and again?

→

Manual tracking led to missing or incorrect data

→

Surprise expenses often broke their systems

→

No app really felt like it was built for them

→

Financial stress is a daily undercurrent

Who we were designing for

Not every student was the same, but a few core behaviors stood out. One key persona we built around:

Mapping the budgeting journey

We mapped out a typical student’s current budgeting flow and analyzed where uncertainty shows up, where friction exists, and where design could help users feel a little more in control.

How might we

Reduce the friction of expense tracking for students while supporting flexible, adaptable budgeting?

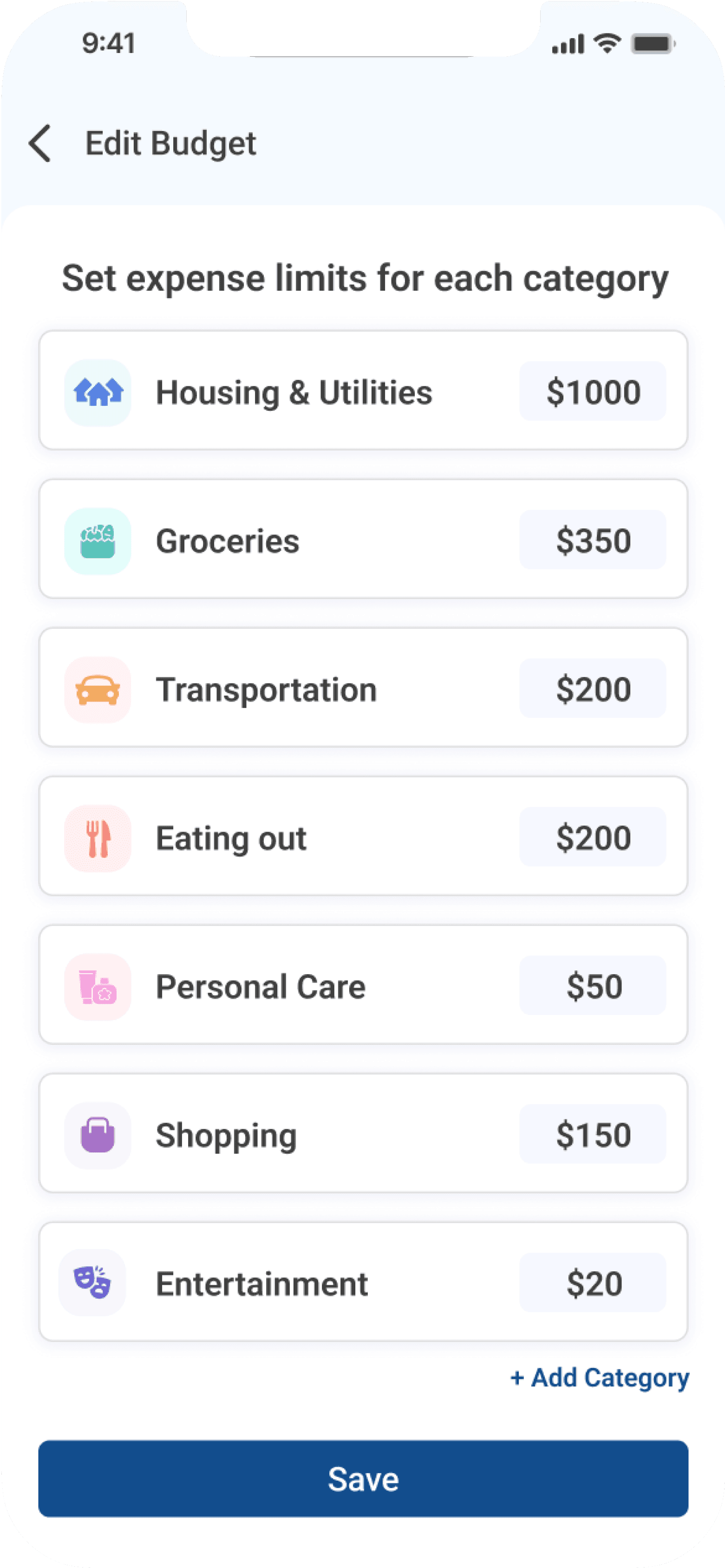

Shaping the right features

We ran an open-ended ideation session rooted in the findings. Using mind mapping, we explored every pain point and generated feature ideas around them.

Testing the initial concept

We tested our low-fidelity prototype with 8 students from varied backgrounds and received crucial feedback that helped us refine the design.

→

Many pointed out that the home screen lacked clarity. They wanted a more detailed breakdown of their budget without having to dig through multiple screens.

→

The alert system we introduced to flag overspending was well-liked. A few even mentioned it’d help them pause and rethink non-essential purchases.

→

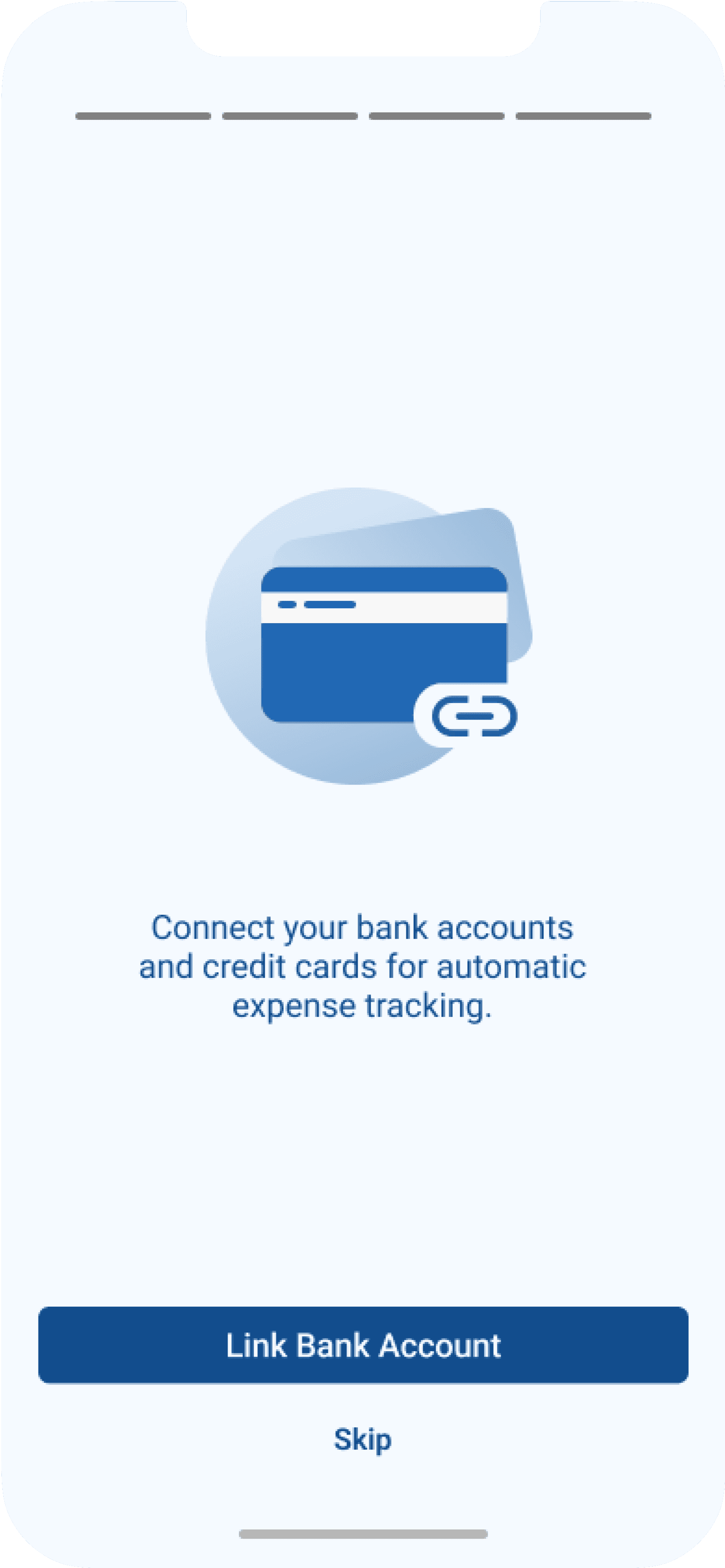

Students also responded positively to auto-categorization of expenses through bank linking, though a few emphasized the need to easily correct or rename categories when the system got it wrong.

→

A recurring theme was the desire for some kind of financial guidance. This was our push to explore voice assistance that could answer quick questions or help log expenses without typing.

Final design

Onboarding

Budget setting and tracking

Transaction logs

AI assistance

Observed impact

We tested the final prototype with 10 students through moderated usability sessions. Each participant was asked to complete key tasks, like setting up a monthly budget, reviewing expenses, and interacting with the AI assistant. We followed this with short interviews and a questionnaire that measured satisfaction, clarity, and ease of use on a 5-point scale. This helped us capture both observed behavior and self-reported feedback to understand the overall usability of the design.

Budgeting confidence

+46% boost

2.8/5

Before PennyPal

4.1/5

After PennyPal

Financial stress

High

Before PennyPal

Low

After PennyPal

User satisfaction

+44% increase

3.2/5

Before PennyPal

4.6/5

After PennyPal

Users liked…

→

Faster expense logging through quick-access features.

→

Reduced financial stress by enabling budget adaptability.

→

Simplified navigation through a clear and intuitive UI.

What I learned

Talking to users showed me that budgeting isn't just about numbers. It's about the emotional weight behind those numbers.

The research process reminded me that good questions matter just as much as good solutions. It also reinforced the need to let go of assumptions and follow what real feedback reveals.